What Are Crypto Asset Product (CAP) Companies and Why They Matter

Defining the term

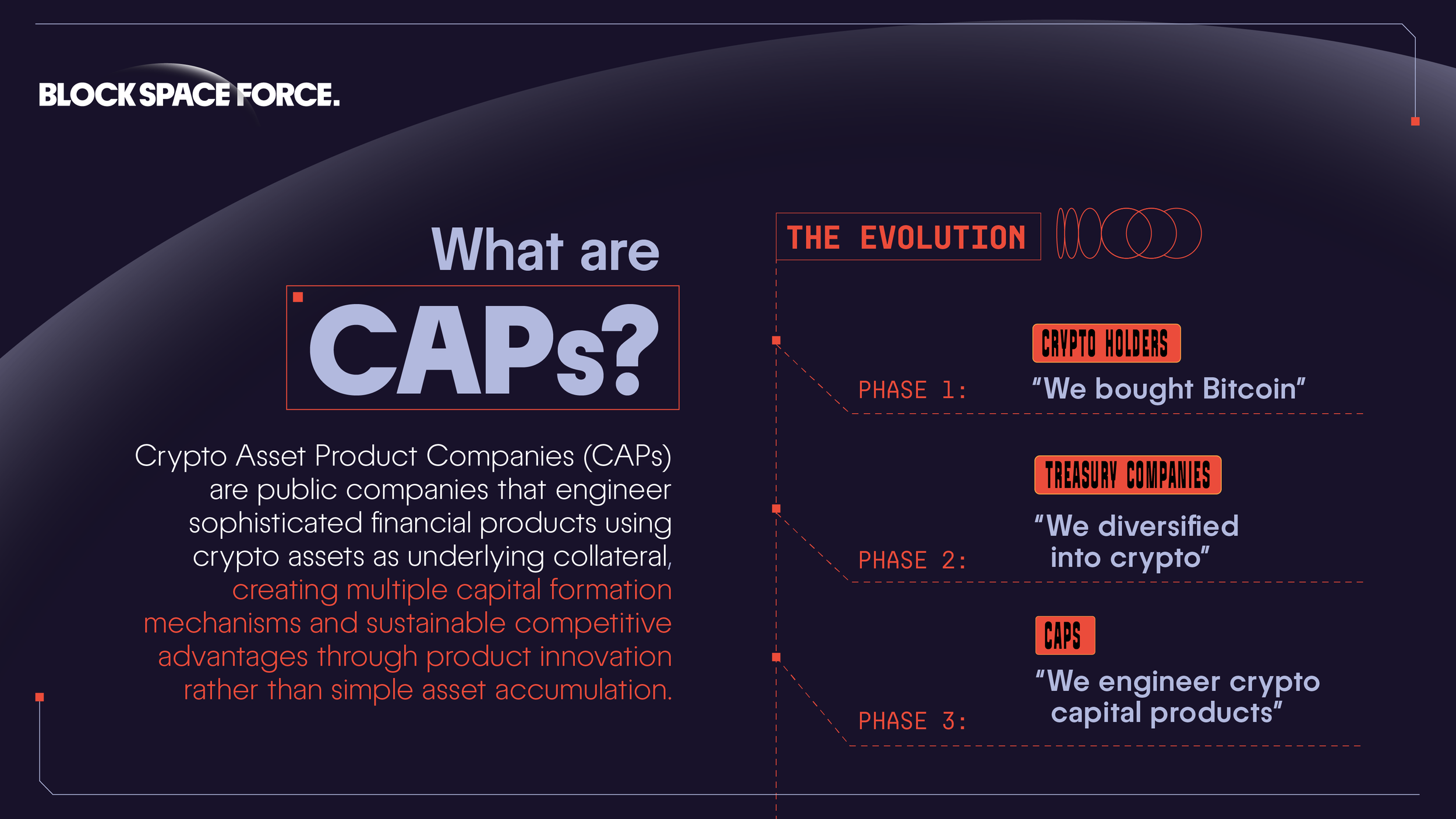

Crypto Asset Product (CAP) companies are public companies that engineer sophisticated financial products using crypto assets as collateral – creating new capital formation mechanisms and sustained market advantages through product innovation, not just asset accumulation.

While Phase 1 was about buying Bitcoin, and Phase 2 about diversifying into crypto, CAPs represent Phase 3 of the evolution:

“We engineer crypto capital products.”

Coined by early-stage investors and firms like BlockSpaceForce, the CAP thesis captures what actually drives premium valuations: financial architecture, product velocity, and NAV-accretive structuring – not passive holding or operational complexity.

In short: CAPs don’t just hold crypto. They build with it: as instruments, infrastructure, and innovation.

Why CAPs Matter

The rise of CAPs represents a structural evolution in how crypto reaches institutional and retail investors alike. Unlike traditional crypto companies (e.g. miners, exchanges), CAPs turn exposure into equity. They don't just hold crypto—they manufacture capital strategies around it.

1. Access Through Securities

CAPs give investors exposure to Bitcoin, Ethereum, or stablecoins without touching a wallet. Whether through spot ETFs, treasury-per-share structures, or token-linked convertible notes, they package digital assets into familiar securities.

2. Capital Markets Liquidity

These structures unlock liquidity on both sides. CAPs raise equity or debt to acquire crypto, and investors gain liquid, regulated access via public shares. This dynamic creates flywheels where strong NAV performance fuels capital inflow, enabling further crypto acquisition.

3. Accounting Clarity

With new FASB rules in place from 2025, public companies can now mark crypto to fair value – eliminating the previous asymmetry that penalized unrealized gains. CAPs are now structurally advantaged in reporting crypto performance.

Capital Strategy Archetypes

While many companies are "crypto-exposed," not all are CAPs. Here's how CAPs are categorized:

A. Product Issuers / Sponsors

Some firms act as product issuers — but only become CAPs when they use crypto-linked investment products to raise capital, structure balance sheets, or generate reflexive exposure to digital assets.

Examples include:

Spot ETFs / ETPs

Trusts or Notes backed by BTC or ETH

They earn fees and structure access for investors, competing on pricing, liquidity, and product design.

B. Treasury-Heavy Public Companies

These firms raise capital specifically to acquire crypto. Their balance sheets are the product.

Examples include:

Strategy ($MSTR)

Metaplanet (3350.T)

Nakamoto ($NAKA)

They use ATMs, convertibles, IPOs, and other tools to raise funds and grow crypto-per-share metrics. Their stocks often trade at a premium to NAV, reflecting this engineered exposure.

C. Financialized Crypto Platforms

Operating companies like exchanges or miners may evolve into CAPs when they:

Adopt treasury accumulation strategies

Launch structured crypto-linked instruments

Use platform economics to bootstrap asset accumulation

Examples include:

Hut 8 ($HUT)

Block ($SQ)

Robinhood ($HOOD)

These companies sit at the intersection of product, infrastructure, and treasury innovation.

Not all treasury models are CAPs. Here’s how they compare:

DATs vs CAPs: What's the Difference?

| DATs (Digital Asset Treasury Companies) | CAPs (Crypto Asset Product Companies) | |

|---|---|---|

| Core Mindset | “We hold crypto on our balance sheet.” | “We engineer capital products around crypto assets.” |

| Product Approach | Static asset allocation | Dynamic product creation |

| Capital Mechanism | Single exposure instrument | Multiple capital instruments |

| Strategic Focus | Treasury diversification mindset | Financial architecture mindset |

| Value Capture Style | Passive value capture | Active value engineering |

This is where CAPs differentiate: not by how much they hold, but by how they structure value.

How CAPs Engineer Value

Crypto Asset Product (CAP) companies don’t just hold crypto — they make it more productive through capital structuring.

Coined by early-stage investors and firms like BlockSpaceForce, “CAP” refers to companies that use crypto assets like BTC, ETH, or SOL as core collateral to design financial products that generate shareholder value.

This includes:

Issuing equity or convertible debt above NAV to fund crypto accumulation

Structuring yield products tied to staking, lending, or on-chain flows

Designing treasury instruments that amplify token-per-share exposure

Unlike passive holders or ETF sponsors, CAPs are active builders in capital markets. Their value comes from engineering products that are reflexive, accretive, and tightly aligned to crypto upside.

Premium valuations aren’t just rewarded for holding tokens – they’re earned by creating the financial rails that make them work harder.

Evaluating a CAP

We break it down in our 3-Part Evaluation Framework for CAPs.

But key questions include:

How is crypto exposure structured? (Direct vs. indirect)

How is capital raised and deployed? (Equity, convertibles, debt)

Is the model NAV-accretive or dilutive?

What are the treasury, product, and regulatory risks?

Download our 3-Part Evaluation Framework

A practical toolkit to evaluate crypto exposure, capital structure, and NAV-accretive design in public-market CAPs.

Why This Matters Now

We’re in the early innings of a trillion-dollar shift. Regulatory clarity, accounting reform, and product maturity have created fertile ground for CAPs to scale. As ETF access expands, more companies are raising capital to launch treasury-driven or product-linked crypto strategies.

Recent moves by Metaplanet ($3350.T), Strategy ($MSTR), and crypto-focused funds like HashKey’s Digital Asset Treasury (DAT) initiative – alongside new entrants like Twenty One ($CEP) and Nakamoto ($NAKA) – point to a future where public companies don’t just hold crypto. They turn it into capital strategy.

The Crypto Asset Product (CAP) model marks a fundamental evolution in how value is unlocked from crypto; not through passive exposure, but by structuring financial products atop digital assets.

As adoption accelerates, CAPs are fast becoming the preferred vehicle for public-market crypto exposure, with leverage, innovation, and market fit built in.

Explore the full investment thesis behind CAPs and blockstocks in our Fund Thesis.

For more insights on CAPs, blockstocks, and crypto capital innovation, follow BlockSpaceForce on Twitter and LinkedIn.