The Current State of Blockstocks and What to Expect Next

By Charles Chong, VP of Strategy, BlockSpaceForce

Blockstocks — public companies strategically adopting crypto assets — have rapidly emerged as a defining theme in 2025 crypto and capital markets. The category spans a wide spectrum, including pure-play crypto companies like Coinbase and Circle, crypto-adjacent platforms like Robinhood, established firms that integrate crypto into traditional business models, and treasury-focused entities whose primary mandate is holding and monetizing digital assets.

This last group represents a particularly novel evolution, allowing equity investors to gain exposure to BTC, ETH, SOL, and other tokens while giving management the optionality to execute treasury strategies, raise capital, and pursue adjacent initiatives.

Following a surge of activity earlier this year, the past two months have provided a useful pause to assess the sector's current standing. This note reviews recent performance, the structural pressures now shaping outcomes, and what to expect over the next three to six months.

Market Snapshot: From Growth to Compression

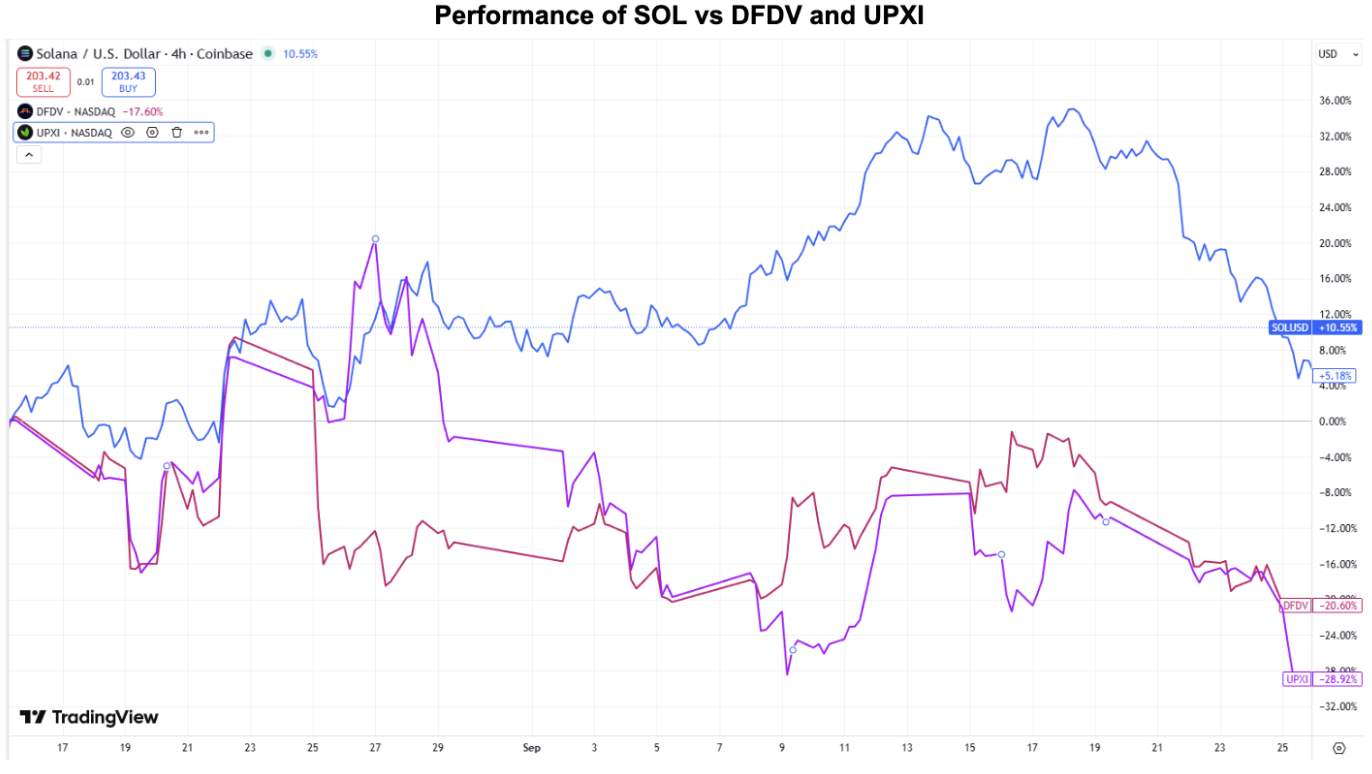

Over the past six weeks, blockstocks have underperformed their underlying tokens, signaling mNAV compression.

However, even as the sector softens, launches continue — most prominently $FORD's $1.65 billion raise led by Galaxy Digital, Jump Crypto, and Multicoin Capital, alongside other entrants like $HSDT (SOL), $STSS (SOL), $BREA (SOL), $AGRI (AVAX), $ZONE (DOGE), $ORBS (WLD), $PAPL (INJ) and many others.

Early vs. Late Movers

As shown in the table below, early blockstocks delivered better returns for PIPE investors.This was partly structural — with only a handful of names in the early days, liquidity was concentrated and investor attention amplified. Timing was also favorable, coinciding with rising crypto markets. For example, $SBET launched when ETH traded at ~$2,600, with the token later peaking at $4,800 before settling around $4,000.

In contrast, today’s environment is more crowded, with over 100 Bitcoin treasury companies and more than 10 for ETH and Solana. Differentiation is harder, fatigue among investors is visible, and hype-driven premiums have diminished alongside broader crypto downturn. Blockstocks remain a higher-beta play on crypto prices, but the amplification is now cutting both ways.

While PIPE entry provided strong upside for early investors, the open market has also offered compelling opportunities. Many blockstocks today trade below 1.0x mNAV and even below PIPE entry prices, meaning new investors can sometimes secure a better cost basis than the original PIPE participants. For example, $SBET fell to around $9 per share after shares registration before rallying to $40, giving opportunistic buyers in the market a fourfold return even without PIPE access.

Case Studies: Execution vs. Fragility

NAKA: Shares surged to $30+ post-announcement but collapsed more than 95% toward PIPE entry levels once registration allowed liquidity. This reflects the typical cycle: small floats lead to sharp pre-registration pumps, but gains often unwind as PIPE investors monetize.

BMNR: A contrasting success. Execution and timing worked in its favor:

Deployed an ATM during the post-announcement rally, issuing shares well above NAV and accreting treasury assets.

Benefited from ETH’s rally, which expanded NAV/share materially.

Staggered PIPE unlocks — 50% at registration, 50% 30 days later — dampening immediate sell pressure.

As a result, when PIPE shares were registered, NAV/share had grown to ~$30, roughly in line with the trading price, mitigating forced selling.

Q3 Launches: Conditions were less forgiving. With crypto weakening, most blockstocks fell short of the anticipated 2x+ NAV multiples. Many ($EMPD, $SBET, $ALTS, $SUIG, $BNC, $TONX, $BTCS, $ETHZ) have traded below 1.0 mNAV and some are resorting to share buybacks. However, this approach is unsustainable: cash reserves deplete quickly, and liquidating tokens to fund repurchases risks triggering a downward spiral. Meanwhile, consolidation has begun, highlighted by $ASST’s acquisition of $SMLR and rumors that $ETHZ may pursue a sale after adopting golden-parachute protections.

Looking Ahead

If crypto markets regain momentum in Q4, speculation and hype could drive another wave of mNAV expansion. Historical analogs exist: Strategy’s NAV recovered from below 1.0 in the bear market to ~4.0 in late 2024.

Blockstocks remain a new concept, with many institutions still in the early stages of understanding and preparing to deploy into the space. Interest hasn’t disappeared as events and panels at major crypto conferences continue to spotlight the theme.

For investors, the key decision points are:

Participate in new PIPEs;

Accumulate underperformers trading below NAV, hoping for turnarounds;

Ride momentum in outperforming blockstocks; or

Bypass the structure altogether and simply own the underlying tokens.

Whichever path they choose, investors must form a forward-looking view on crypto prices, overall market sentiment in blockstocks, and the execution capabilities of management teams.

If blockstocks follow the path of prior crypto manias (NFTs and memecoins), we may be in the consolidation phase before a broader, more durable rally.

Conclusion

Blockstocks remain a novel and experimental bridge between capital markets and crypto. The past few months have underscored both their potential and their fragility. While early entrants captured oversized premiums, today’s environment requires sharper execution and tighter playbooks.

The next three to six months will test which teams can differentiate, sustain NAV accretion, and manage shares registration dynamics effectively. For investors, selectivity and timing will be critical as the sector evolves from hype to discipline.

Charles Chong is the Vice President of Strategy at BlockSpaceForce, where he leads research on blockstocks (public companies with direct crypto exposure) and the evolving intersection of Bitcoin treasuries, capital markets, and digital asset strategies. The views expressed are his own.