Insights from Strategy’s Q3 Earnings

Strategy, $MSTR, continues to redefine what a public company can be. Its transformation from a traditional software firm into a full-scale Bitcoin-backed financial institution took another step forward in Q3.

Let’s break down what’s happening:

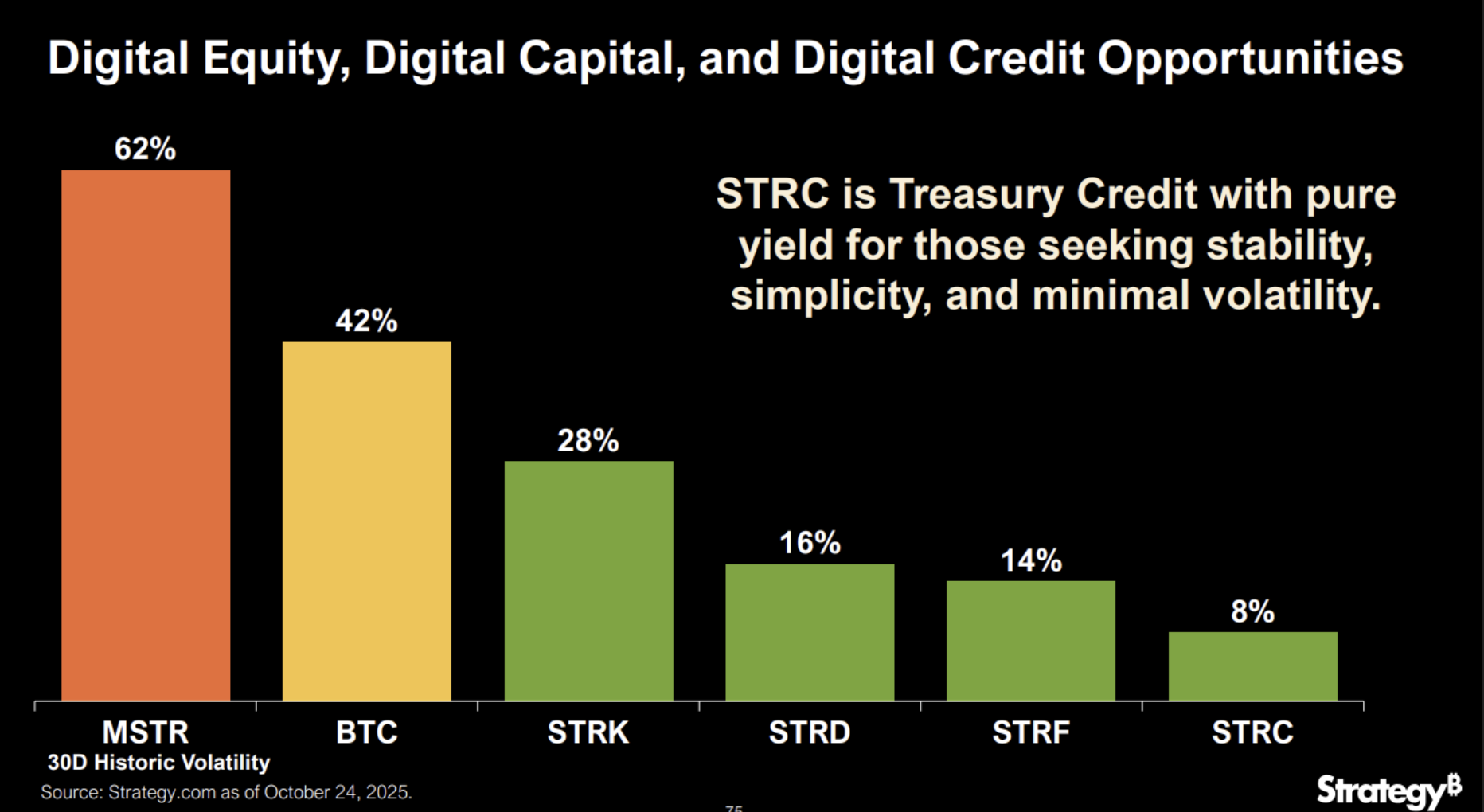

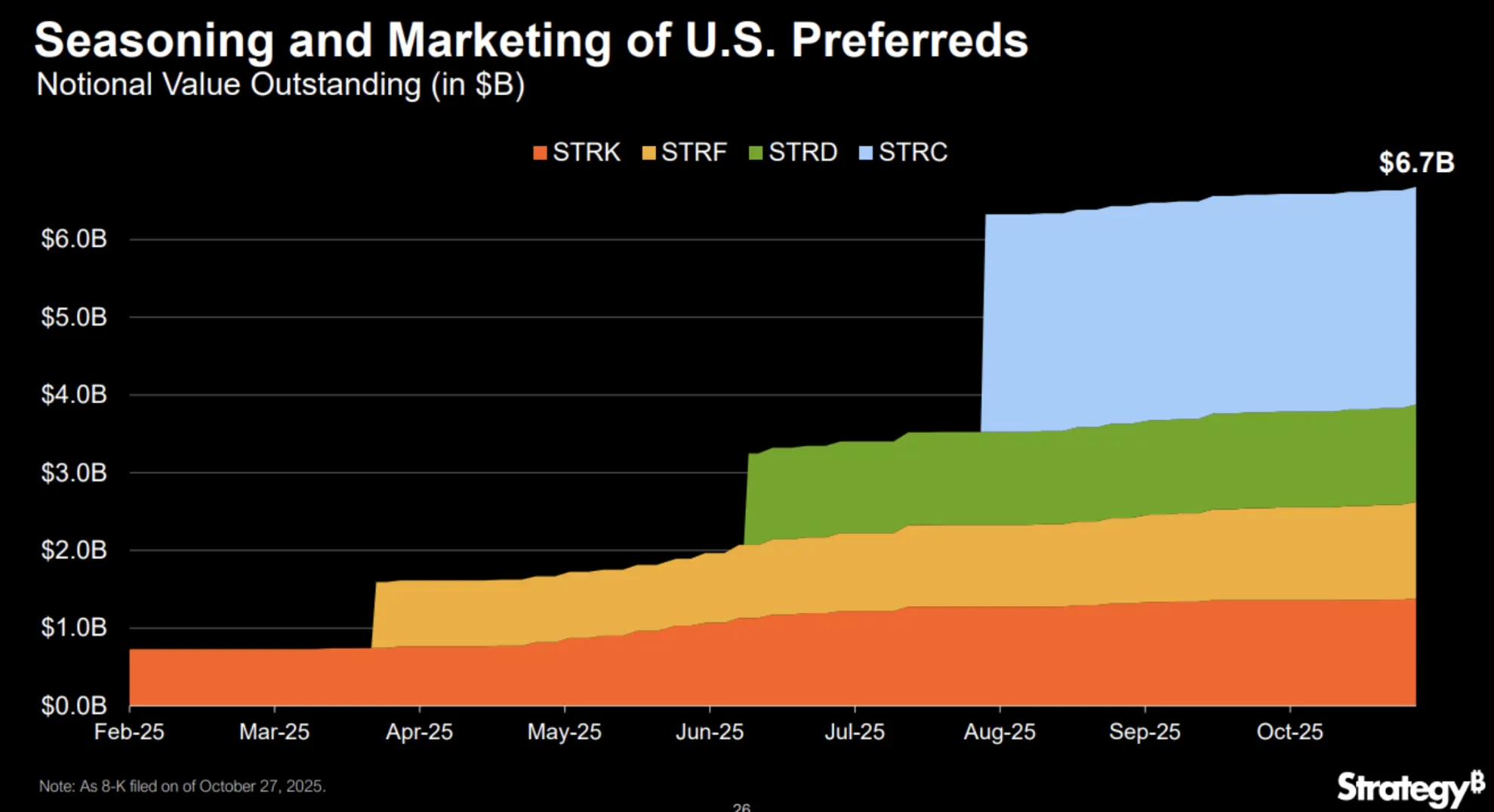

Recap on the STR Preferreds (STRF, STRC, STRK, STRD)

Strategy has created a family of financial instruments called perpetual preferred shares, each with different levels of risk and reward. Think of these as layers in a financial “sandwich,” from safest at the top to riskiest at the bottom.

Here’s the quick rundown:

STRF → Most senior and safest. It’s secured by Bitcoin and sits at the top of the stack.

STRC → Stable and short-term. Acts like a money market-style product, with monthly dividend adjustments that keep it trading close to $100.

STRK → Riskier, with upside. Includes a $1,000 call option on $MSTR, giving investors some equity-like exposure.

STRD → Highest yield, highest risk. It’s the most junior instrument, meaning it gets paid last if things go wrong.

Seniority ranking: STRF ➜ STRC ➜ STRK ➜ STRD

Key Themes from the Q3 Earnings

Strategy’s Q3 update made one thing crystal clear:

Bitcoin accumulation remains the core mission.

Here are the highlights:

The company reaffirmed that BTC per share is their main KPI (key performance indicator).

Management aims to grow Bitcoin yield by 30% in 2025, implying roughly $2 billion in new capital needed.

The recent S&P ‘B-’ rating expanded Strategy’s digital credit addressable market from $2.8T to $4.9T

Strategy has raised $19.8 billion year-to-date, now owning about 3.1% of all Bitcoin in existence at an average price of $74,000.

“Digital Credit”, their term for Bitcoin-backed debt, is now the centerpiece of their strategy.

Management stated that acquiring other BTC treasury companies would be a distraction compared to scaling Digital Credit

There is a continuing need to advocate for improved treatment of Bitcoin as a capital asset under RAC and the Basel Framework

They’re expanding the STR preferred program globally, with versions available in multiple currencies.

They are building out a global marketing and distribution engine to drive broader retail and institutional adoption of Digital Credit

In line with their efforts to broaden its distribution engine, STR-series preferreds are now available on Robinhood, opening access to retail investors.

“Amplification” is replacing the word “leverage” as they phase out convertible debts

Management even highlighted a potential path to S&P 500 inclusion in the future.

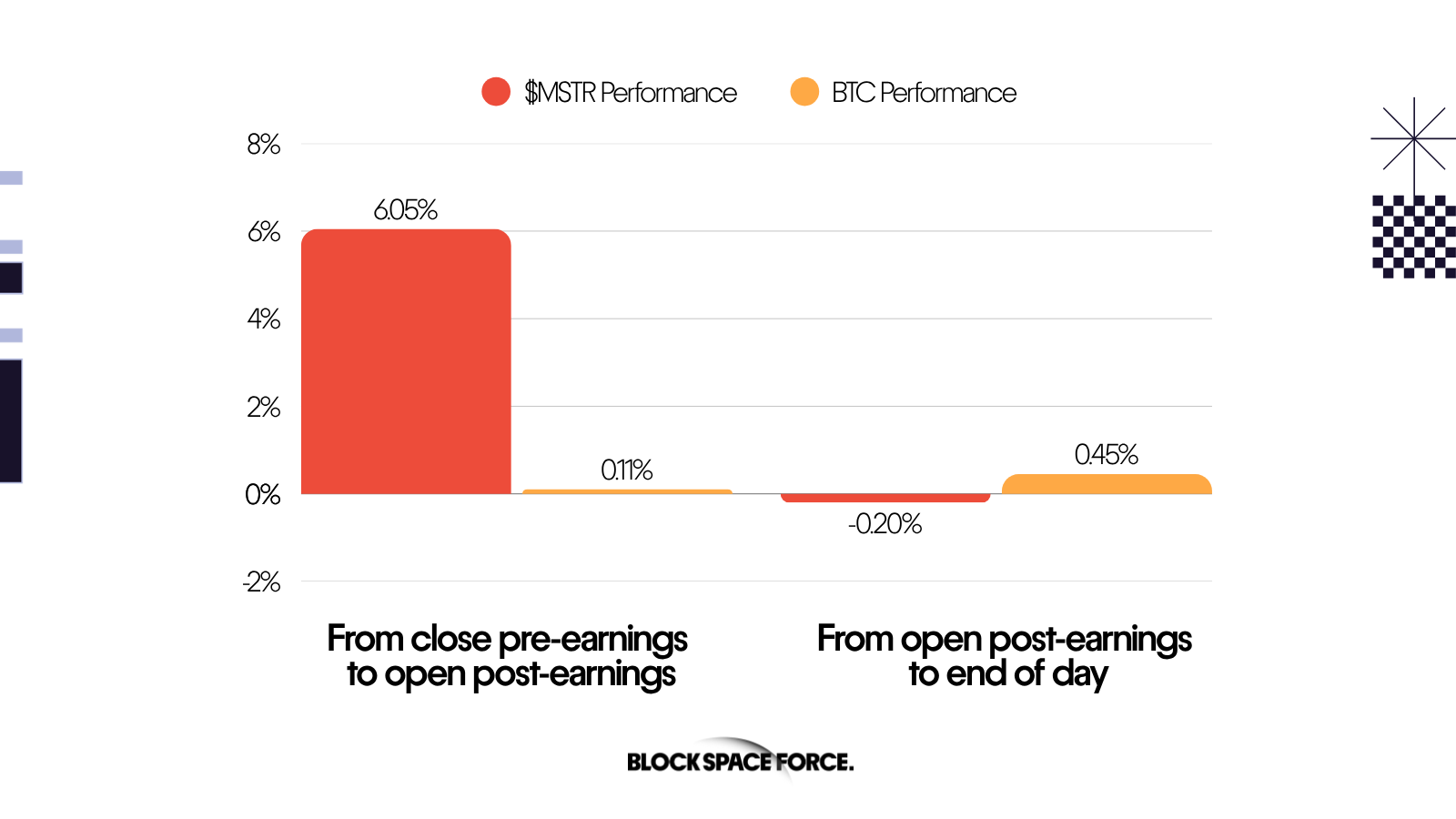

How the Market Reacted

Despite transparent information on balance sheet and bitcoin developments, $MSTR rallied after the earnings call, proof that investor confidence, clarity of direction, and storytelling still matter as much as raw numbers for DATs.

The call boosted morale, but broader market caution (and Bitcoin’s small dip) pulled prices back.

How Each STR Performed

Each of MicroStrategy’s preferreds behaved differently:

STRF: Most stable, but still dipped with Bitcoin, showing BTC isn’t yet treated as “safe” collateral.

STRC: Climbed steadily to its $100 target (now ~$99.38).

STRK: Moved like $MSTR stock due to its built-in call option.

STRD: Fell less than STRK.

$MSTR stock: Declined sharply, the most volatile part of the stack.

Based on today’s leverage/amplication and mNAV Strategy’s equity (MSTR) should move about 1.18x Bitcoin’s performance, meaning it magnifies Bitcoin’s ups and downs.

Risk Premiums and Why They Matter

Strategy’s preferreds pay higher yields than typical market instruments.

That’s not necessarily a good thing. It’s the market saying Bitcoin is still considered risky collateral.

Over time, the goal is to reduce those yields (and therefore risk premiums) as investors grow more comfortable with Bitcoin-backed assets.

Saylor’s bet is simple:

If Bitcoin grows faster than the interest rates Strategy pays, the model works.

Historically, Bitcoin’s growth rates have been explosive:

3-year CAGR: 76%

5-year CAGR: 51%

10-year CAGR: 75%

Even a conservative 30% annual growth rate would be enough for this system to sustain itself as long as risk premiums gradually fall.

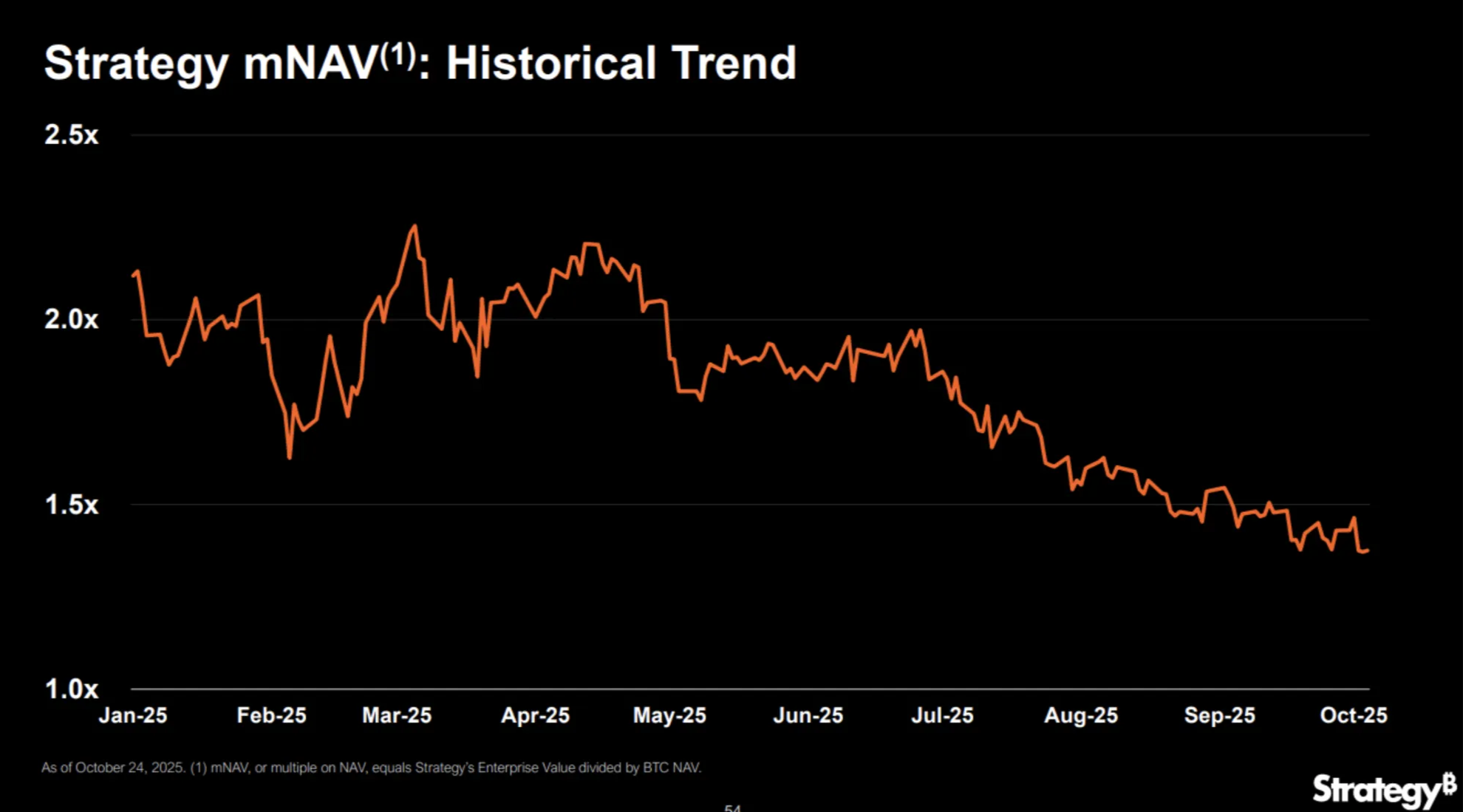

BTC Per Share – The Core Metric

“Bitcoin per share” has become the central metric Saylor wants everyone to watch.

It reflects how much BTC each share of $MSTR represents.

But here’s the catch:

This metric depends on market value (mNAV) and leverage/amplification, not just operational success.

mNAV has been sliding since May (currently 1.38), which limits how much more Bitcoin Strategy can accumulate with just issuing new shares.

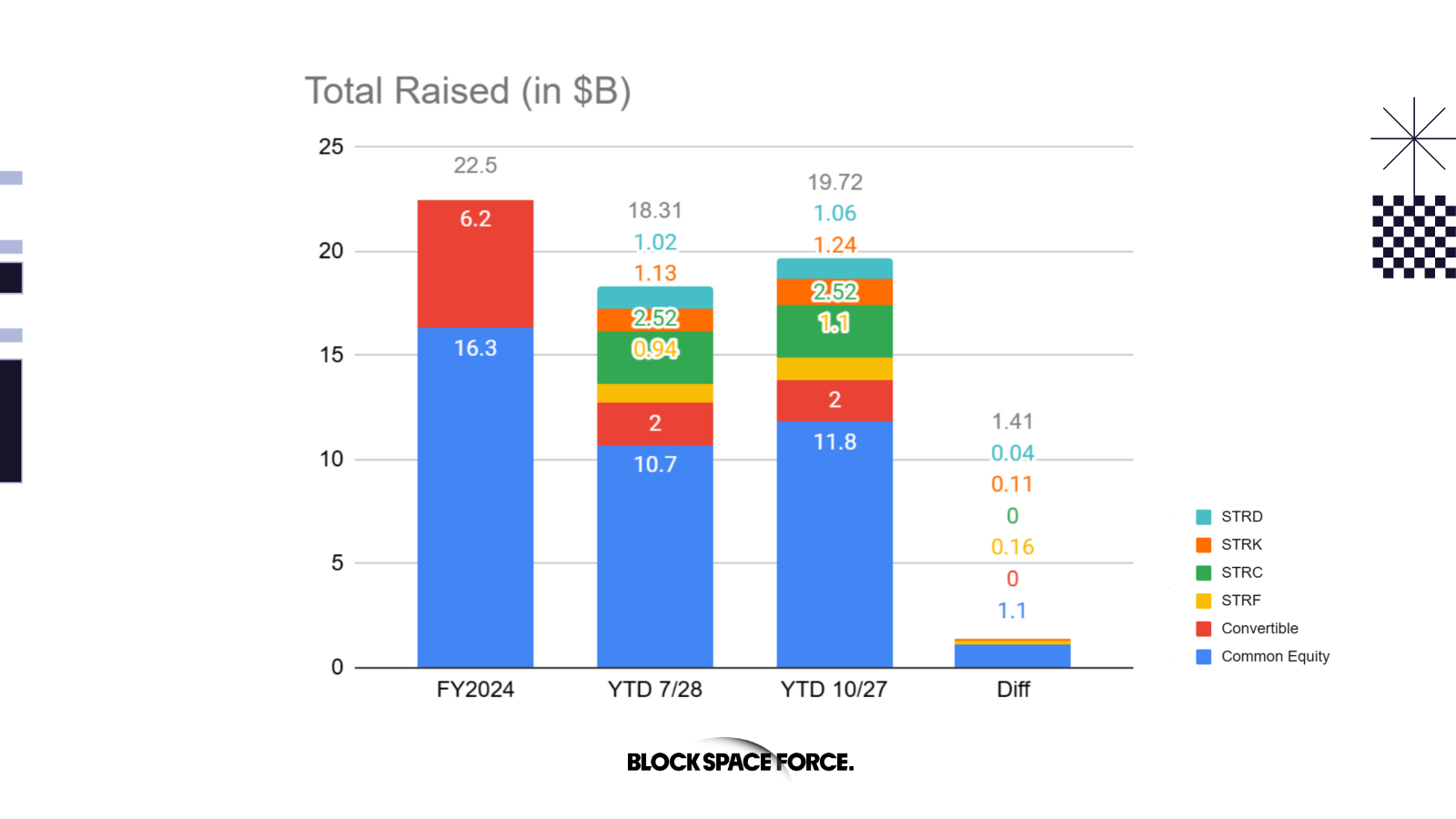

Funding, Dividends & Cash Flow

Most of the company’s fundraising happened earlier this year, with only 7% in Q3.

Cash reserves sit around $54 million, and the software business is running roughly break-even.

That means Strategy relies heavily on its ATM program (selling new shares of $MSTR) to fund interest and dividends. About $148 million of the $1.41B raised recently went to those payments.

While they could pause dividends on certain preferreds, that would signal distress, something they clearly want to avoid.

The first major debt maturity isn’t until September 2028, giving them time.

Still, execution discipline will be key.

BTC Rating System – A Guide to Risk

Strategy introduced a “BTC Rating” system to show how much Bitcoin backs each dollar of its preferreds:

Ideally, the company should issue more STRD to match this system.

Instead, it has leaned toward STRF and STRK a disconnect between strategy and execution.

The advantage of MicroStrategy’s preferred structure is that it avoids liquidations or margin calls, unlike traditional leverage. This is a key feature that allows them to maintain long-term Bitcoin exposure even through volatility.

However, on August 18, the company filed guidance stating it would limit ATM (at-the-market) share issuance when mNAV falls below 2.5x.

Despite that, in the weeks ending August 24, August 31, September 7, and September 21, MicroStrategy still issued about $1B worth of new MSTR shares via the ATM to buy more Bitcoin, even though mNAV was trading around 1.5x at the time.

This highlights an ongoing tension between strategic discipline and aggressive Bitcoin accumulation.

Wall Street Coverage

The unanimous Buy ratings highlight the strong institutional appeal of Strategy in public markets. Coverage from top Wall Street banks signals that the story resonates, and Strategy continues to command attention among analysts and investors.

The Road Ahead

Looking forward, Strategy’s direction remains bullish but disciplined:

A potential S&P 500 inclusion would be a major credibility milestone.

The recent S&P B- rating expanded its addressable credit market to nearly $5 trillion.

Reaching investment grade could unlock access to $23 trillion in institutional capital.

However, unless the company’s mNAV expands, Bitcoin accumulation will slow.

Digital Credit alone can only support around 20% more BTC before hitting BTC rating limits.

To keep growing meaningfully, Strategy might need to acquire other Bitcoin treasury companies trading below their asset value, a move that could supercharge BTC per share growth and allow for even more digital credit issuance.

Bottom Line

Strategy is becoming a Bitcoin-native financial institution, using innovative preferred structures to create a new kind of credit market.

But the strategy only works if:

Bitcoin keeps outperforming yields, and

Management sticks to its own guardrails (especially around mNAV and issuance discipline) to instill confidence.

Saylor’s vision is ambitious, turning Bitcoin into a new kind of global collateral.

Charles Chong is the Vice President of Strategy at BlockSpaceForce, where he leads research on blockstocks (public companies with direct crypto exposure) and the evolving intersection of Bitcoin treasuries, capital markets, and digital asset strategies. The views expressed are his own.